Last Updated: 07 February 2026

Many investors want to know where this stock can go in the future with NTPC green energy share price targets for 2025, 2026, 2030, 2035, 2040 and 2050. One of the biggest companies in India’s renewable energy sector is NTPC Green Energy Limited. So today, in this article, we will analyse this stock very simply. The main things we will analyse are NTPC Green Energy (NGEL) future share price targets, fundamental analysis, Technical Analysis, financial performance, sector outlook, peer analysis, and what are the good and bad sides of the company. etc, so that you can get a clear idea of how this stock can perform in the next few years.

NTPC Green Energy Share Price Target (2026 to 2050) – Quick Overview

| Year | Minimum Price | Maximum Price |

|---|---|---|

| 2026 | ₹79 | ₹230 |

| 2027 | ₹165 | ₹330 |

| 2028 | ₹267 | ₹430 |

| 2029 | ₹345 | ₹550 |

| 2030 | ₹450 | ₹850 |

| 2035 | ₹1,000 | ₹1,550 |

| 2040 | ₹1,600 | ₹1,960 |

| 2050 | ₹2,600 | ₹2,950 |

What is NTPC Green Energy Ltd NSE: NTPCGREEN?

NTPC Green Energy is a subsidiary of NTPC Limited. The Government of India established NTPC Green in April 2022 with the aim of accelerating the pace of renewable energy. NGEL is India’s largest renewable energy-generating PSU company, excluding hydro power. Apart from renewable energy, the company is now focusing on green hydrogen, green chemicals, battery energy storage (BESS) and carbon credit business.

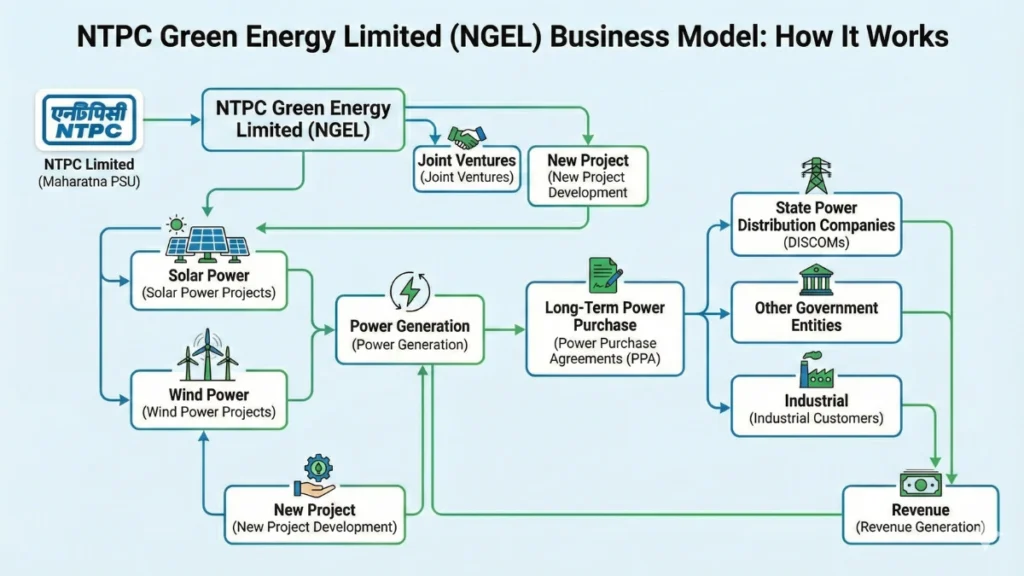

Business Model: The company currently generates 91% of its total revenue from solar energy sales, 4.5% from wind energy sales, and 1.5% from consultancy & project management fees. The best part of NGEL is that the company works on a long-term power purchase agreement (PPA) model. It enters into PPA agreements with other PSU companies, apart from the central and state government power distribution companies, and it is usually for 25 years. The company also does its business through joint ventures with various companies and states, such as Indian Oil NTPC Green Energy (INGEL) 50:50 JV, ONGC NTPC Green (ONGPL) 50:50 JV, AP NGEL Harit Amrit Limited 50:50 JV, etc.

NTPC Green Energy Live Share Price Chart ( Today’s Price )

NTPC Green Energy Share Price Target Analysis (2026-2050)

In this section, we analyse NTPC Green Energy’s expected share price movement from 2026 to 2050 based on business growth, sector outlook, financial performance and long-term demand for renewable energy.

NTPC Green Energy Share Price Target 2026

The Indian government is giving importance to this renewable energy sector, especially renewable energy, green hydrogen, and is taking one plan after another and implementing it. A few days ago, the Union Cabinet approved ₹20,000 crore to invest in NGEL. It is also officially said by the government that currently the NGEL renewable energy generation capacity is 32 GW, of which 6 GW is operational, 17 GW under award and 9 GW in the pipeline. This capacity will be increased to 60 GW by 2032.

NTPC Green’s current operational capacity of 6 GW will be increased to 11 GW by 2026. This will increase both the company’s revenue and profit as the company has a lot of orders. And if the Indian government announces some new policies in the budget for 2026 to boost this sector in a better way, then NGEL’s shares can show strong uptrend momentum. Considering NTPC Green’s capacity expansion and government renewable sector push, the estimated share price target for 2026 ranges from ₹79 to ₹230.

| Month | Minimum Price | Maximum Price |

|---|---|---|

| January | ₹79 | ₹111 |

| February | ₹81 | ₹132 |

| March | ₹95 | ₹148 |

| April | ₹110 | ₹165 |

| May | ₹118 | ₹175 |

| June | ₹120 | ₹178 |

| July | ₹125 | ₹180 |

| August | ₹132 | ₹185 |

| September | ₹138 | ₹195 |

| October | ₹145 | ₹210 |

| November | ₹153 | ₹222 |

| December | ₹162 | ₹230 |

NTPC Green Energy Share Price Target 2027

This stock can see better growth in 2027 as the company targets to reach 19 GW RE this year. Apart from this, solar projects like Khavda VIII (275 MW), Khavda IX (275 MW), Bikaner block 1 (325 MW) and Bikaner block 2 (325 MW) are likely to start one after the other this year. Out of these, the most major expansion can be seen in Uttar Pradesh, where the company is building a (1400 MW) grid-connected solar power project, as UP is India’s third largest power-consuming state.

Once these projects are launched, the company’s revenue, profit and cash flow will definitely increase. Due to the increasing demand for renewable energy, the launch of new projects and the improvement in the company’s financial position, NTPC Green Energy’s share price is expected to range between ₹165 to ₹330 in 2027.

| Year | Minimum Price | Maximum Price |

|---|---|---|

| 2027 | ₹165 | ₹330 |

NTPC Green Energy Share Price Target 2028

The Indian government sees green hydrogen as the future of the country’s energy security and has launched the National Green Hydrogen Mission (NGHM). The government aims to produce 5 million metric tonnes (MMT) of green hydrogen per year by 2030 and add about 125 renewable energy capacity for green hydrogen production. The government will invest ₹8 lakh crore in this sector.

NTPC Green is investing around ₹1.85 lakh crore rupees to set up India’s largest green hydrogen hub. The hub is being set up at Pudimadaka near Visakhapatnam in Andhra Pradesh. Once the hub is set up, it will produce 1,500 tonnes of green hydrogen per day and 7,500 tonnes of hydrogen derivatives such as green urea, green methanol and sustainable aviation fuel per day. The government’s investment in green hydrogen and the company’s creation of the largest green hydrogen hub could see NTPC Green Energy’s stock price target between ₹267 to ₹430.

| Year | Minimum Price | Maximum Price |

|---|---|---|

| 2028 | ₹267 | ₹430 |

NTPC Green Energy Stock Price Target 2029

India’s renewable energy sector is expected to grow at a CAGR of 15% between 2025 and 2030 or even more because the Indian government is very seriously pushing this sector to grow. The Indian government’s target is to build a total of 500 GW of non-fossil power means (solar, wind, hydrogen) projects by 2030, so that at least 50% of the country’s electricity demand can be met with renewable energy. But you will be happy to know that the government has officially announced that India is generating 242.8 GW of electricity from non-fossil sources in 2025, which means that the target has already been achieved before the scheduled time.

As a result, the government is said to invest more in this sector, and NGEL will get more benefits because it is a government PSU company, which can direct impact on NGEL’s balance sheet. The demand for electricity in India is likely to increase significantly by 2029. Due to this increase in demand, NGEL’s business will also increase. So, analysing all aspects, it can be said that the NTPC Green Energy share price target in 2029 can be between ₹345 to ₹550.

| Year | Minimum Price | Maximum Price |

|---|---|---|

| 2029 | ₹345 | ₹550 |

NTPC Green Energy Share Price Target 2030

By 2030, NTPC Green will not only increase its renewable capacity but also generate a major portion of its revenue from Round-the-Clock (RTC) green power, hydrogen-based industrial energy, green ammonia export, and large-scale battery–hydrogen hybrid storage. Under the National Green Hydrogen Mission, the government aims to make India a global hub for green hydrogen and export green hydrogen to the EU, Japan, and South Korea, as well as the rest of the world. The India–Middle East–Europe Corridor (IMEC) is likely to become operational by 2030, opening up new international routes for ammonia and hydrogen exports from India, and NTPC Green could be a major supplier in this corridor.

State-owned enterprises that will make green electricity mandatory under the government’s Energy Security Policy 2030, such as Railways, Metro Corporations, Government Data Parks, Smart Cities, can get their bulk electricity orders directly from NGEL. Considering NTPC Green Energy’s expanding renewable portfolio, green hydrogen export potential and strong government support. The estimated share price target for 2030 ranges between ₹450 to ₹850.

| Year | Minimum Price | Maximum Price |

|---|---|---|

| 2030 | ₹450 | ₹850 |

NTPC Green Energy Share Price Target 2035

The company has already crossed the 60 GW milestone by 2035 and is on track to generate 70-80 GW of renewable energy. The huge and stable revenue from the 60 GW plus capacity will strengthen the company’s balance sheet, and there will be almost no income risk due to long-term contracts. Many coal plants will start phasing out from 2030 onwards, and NTPC’s renewable arm will have to play a bigger role in the government’s “Net Zero 2070” roadmap. Together, these could see revenue, EBITDA margin and long-term contracts increase significantly in 2035, which could strengthen the share price in the long term. NGEL’s stock price target for 2035 could be in the ₹1,000 to ₹1,550 range.

| Year | Minimum Price | Maximum Price |

|---|---|---|

| 2035 | ₹1,000 | ₹1,550 |

NTPC Green Energy Share Price Target 2040

The demand for electricity in India and the whole world will continue to increase, so the demand for this business will never decrease. However, the businesses require a lot of land and money, so the company has to take many loans, which results in high interest costs. If the company reduces its loans by 2040, then the profit will increase a lot.

Most of the land this company is renting is developing various projects, as a result of which its own land is very less, which results in high costs and pressure on profit, but to solve this problem, NGEL is increasing its land bank, as a result of which profit will increase along with asset value, which will make the company’s balance sheet stronger. Analysing all these factors, it is estimated that NTPC Green Energy’s share price target for 2040 can be between ₹1,600 to ₹1,960.

| Year | Minimum Price | Maximum Price |

|---|---|---|

| 2040 | ₹1,600 | ₹1,960 |

NTPC Green Energy Share Price Target 2050

In 2021, at the COP26 summit, Prime Minister Narendra Modi announced internationally that India will achieve net-zero carbon emissions by 2070. By 2050, India will almost reach the Net-Zero level, and then the country’s major industries, such as steel, cement, refinery, aviation, and fertilizer, will all be required to use clean energy. During this time, NTPC Green’s massive solar, wind, hydrogen and ammonia projects will reduce CO₂ emissions daily, which will generate High-Value Carbon Credits. By 2050, the global carbon market will be even bigger, and many countries and companies will be forced to buy carbon credits to reduce their carbon emissions.

The price of carbon credits generated from green hydrogen and ammonia projects is much higher than that of ordinary renewable credits—this is the biggest advantage of NTPC Green. As a result, the company will not only sell green power, but will also have a big income opportunity by selling carbon credits. This additional revenue, stable PPA income, and hydrogen export will make NTPC Green’s business much stronger in 2050, which can naturally take the share price to a higher level. As per growth, the estimated NTPC Green Energy share price target for 2050 ranges from ₹2,600 to ₹2,950.

| Year | Minimum Price | Maximum Price |

|---|---|---|

| 2050 | ₹2,600 | ₹2,950 |

>> Read More: SJVN Share Price Target 2026, 2030, 2040, 2050 Full Analysis

NTPC Green Energy Technical Chart Analysis

- 50 and 200 EMA Analysis: NTPC Green Energy is trading above the 50 EMA on the daily chart, which is a good signal for a short-term recovery. However, the stock is still below the 200 EMA, which means the overall trend is not yet fully bullish. So, if the price sustains above the 50 EMA for a few days and closes the daily candle above the 200 EMA in the future, then a strong trend reversal will be confirmed, and upside momentum can start.

- Strong Support Level Analysis: Currently, the immediate support for the stock is in the ₹94 to ₹95 level, from where the price has bounced before. If the price holds at this level, the stock can move upwards in the short term. However, if this support breaks, then its next strong support zone is ₹89 to ₹92, which can act as an important accumulation zone.

- Major Resistance Levels Analysis: The first resistance is at the level of rupees ₹100. If this level is broken, the next major resistance will be the level of ₹102–₹106, which is basically the area around the 200 EMA. If this resistance zone is broken, the possibility of the trend being bullish will increase significantly. Above this, the level of ₹115 is a strong long-term resistance, where profit booking can be seen.

- RSI 14 Analysis: Currently, the RSI is hovering around the 66 level, indicating that momentum in the stock has strengthened and buying interest has returned. As the RSI has not yet crossed the overbought zone (70+), further upside momentum could be seen in the short-term.

- Volume Analysis: Volume has been moderate recently. If the volume increases when the price breaks the ₹100 to ₹106 resistance, then the upside move will be much more reliable. No extreme bullish volume spike has been seen so far, so it is important to keep an eye on the volume behaviour for confirmation.

| Indicator | Current Status | What It Means |

|---|---|---|

| Trend | Recovery Phase | Short-term recovery phase |

| 50 EMA | Price above 50 EMA | Short-term positive signal |

| 200 EMA | Price is below the 200 EMA. | The long-term trend is still weak |

| RSI 14 | 65 zone | Strong momentum, not overbought |

| MACD | Improving | Early bullish crossover signal |

| Support | ₹95, ₹89–₹92 | Buyers active level |

| Resistance | ₹100, ₹102–₹106, ₹115 | Seller’s active zones |

NTPC Green Energy Fundamental Analysis

We will see the financial condition of the company by doing a fundamental analysis of NTPC Green Energy Limited. The company’s recent Q2 earnings results and year-over-year financial results are discussed below.

NTPC Green Energy’s Q3 FY26 Quarterly Results

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | |

|---|---|---|---|---|

| Sales | 653 | 612 | 680 | 622 |

| Operating Profit | 535 | 530 | 604 | 560 |

| OPM% | 82% | 86% | 89% | 90% |

| Net Profit | 17 | 86 | 220 | 233 |

| EPS | 0.02 | 0.10 | 0.26 | 0.28 |

Source: screener.in – Quarterly Results Data

NTPC Green Energy Financial Performance ( YoY Results )

| TTM | Mar 2025 | Mar 2024 | Mar 2023 | |

|---|---|---|---|---|

| Sales | 2,568 | 2,210 | 1,963 | 170 |

| Operating Profit | 2,229 | 1,920 | 1,745 | 152 |

| OPM% | 87% | 87% | 89% | 90% |

| Net Profit | 557 | 474 | 343 | 171 |

| EPS | 0.66 | 0.56 | 0.60 | 0.36 |

| Reserves | – | 10,014 | 513 | 168 |

| Borrowings | – | 19,441 | 13,856 | 6,137 |

Source: screener.in – Annual Financial Data

Important Key Metrics

| Metrics | Values |

|---|---|

| Market Cap | ₹ 73,393 Cr |

| Stock P/E | 131 |

| Industry PE | 26.0 |

| PB Ratio | 3.91 |

| ROE | 3.85 % |

| ROCE | 4.89 % |

| Debt to Equity | 1.16 |

Source: screener.in – Key Metrics Data

Brokerages Houses Ratings & Long-Term Opinion

When NTPC Green Energy’s IPO came, some brokerage houses gave some long-term opinions and ratings for the company based on their research. According to an article in business-standard.com:

Reliance Securities

Reliance Securities gave this company a “Subscribe For Long-Term” rating, according to them:

- The company’s credit rating is good.

- The company is very well positioned in new green energy solutions, including green hydrogen and battery storage.

- According to Reliance Securities, long-term investment is a good idea given NGEL’s business model, earnings growth, and the company’s financial health.

SBI Securities

SBI Securities rated NGEL as a long-term subscribe, according to:

- NTPC Green Energy’s operational capacity is expected to increase from 3.3 GW to 6/11/19 GW between FY-25 and FY-27.

- Looking at Revenue, EBITDA and PAT FY-24, the CAGR between FY-27 could increase by 79%, 117% or 123.8%.

Mehta Equities

Mehta Equities analyst Rajan Shinde said there are good reasons to invest in this company long-term:

- NTPC’s extensive resources and expertise make the company extremely strong.

- A total of 26,071 MW capacity (operational+contracted+pipeline) makes NGEL’s future very strong.

Swastika Investmart

Analysts at Swastika Investmart also gave NTPC Green Energy a “Subscribe For Long-Term” rating because, according to them:

- Top-line growth is consistently good.

- The company’s business model is quite good.

NTPC Green Energy Peer Comparison

| Company | PE Ratio | PB Ratio | ROCE | Market Cap |

|---|---|---|---|---|

| NTPC Green | 131 | 3.91 | 4.89 % | ₹ 73,393 Cr |

| Adani Green | 97.1 | 8.20 | 8.70 % | ₹ 1,60,081 Cr |

| JSW Energy | 35.9 | 2.84 | 6.49 % | ₹ 83,146 Cr |

Share Holding Pattern

| Dec 2025 | Sep 2025 | Jun 2025 | Mar 2025 | |

|---|---|---|---|---|

| Promoters | 89.01% | 89.01% | 89.01% | 89.01% |

| FIIs | 1.61% | 1.79% | 1.85% | 1.98% |

| DIIs | 4.80% | 4.63% | 4.66% | 4.87% |

| Public | 4.58% | 4.57% | 4.48% | 4.14% |

NTPC Green Energy Latest News & Updates

- 04 February 2026: NTPC Green Energy Ltd has successfully commissioned 125 MW of the second phase of the Vadla 500 MW solar project in the Phalodi area of Rajasthan. With the addition of the new capacity, the total installed capacity of NTPC Green Energy Group has increased to 8,813.25 MW. Earlier, the company signed an MoU for the supply of green ammonia and renewable power for the Green Urea Plant, and also commercially commissioned the 210 MW portion of the Khavra-II solar project in Gujarat. (Source: businesstoday.in)

- 29 December 2025: NTPC Green Energy Limited announced that another 13.98 MW of solar power capacity from its Khavda-I Solar PV Project in Gujarat has been commercially commissioned from 12 midnight on 30 December 2025. With this new addition, the current commercial capacity of NTPC Green Energy Group has increased to 7,996.30 MW. The total installed capacity has increased to 8,010.28 MW. (Source: bseindia.com)

- 17 December 2025: NTPC Green Energy has commercially commissioned 243.66 MW of its Khavda-I Solar PV project in the Khavda region of Gujarat. This project is part of a total planned capacity of 1,255 MW, which has been operational since 17 December 2025. With this new addition, the total installed capacity of NTPC Limited has increased to 85,503 MW, and the capacity of NGEL Group has increased to about 7,889 MW. This progress has further strengthened NTPC’s renewable energy expansion plan. (Source: ET Energyworld.com)

- 11 December 2025: NTPC Green Energy has commenced commercial production of a new 6.6 MW wind capacity as part of its 100 MW hybrid project at Bhuj, Gujarat. The unit, which is expected to be commissioned from 11 December 2025, takes the company’s total commercial capacity to 7,639.075 MW and its total installed capacity to 7,645.675 MW. (Source: www.business-standard.com)

Is NTPC Green Energy a Good Buy For the Long Term? (Bull Case & Bear Case Explained)

Bull Case:

- The company’s revenue increased by about 12% and net profit by about 38% from FY24 to FY25.

- According to experts, the Renewable Energy sector in India can grow at a CAGR of 15% by 2030.

- Most of NTPC Green Energy’s PSU customers, such as Indian Oil, Coal India, and government-backed power distribution companies in various states, are therefore much less credit risk than private customers.

- Having a long-term PPA (Power Purchase Agreement) keeps revenue stable and risk low.

- Funding, land approval and project execution are faster than others due to the strong support of the NTPC parent company.

Bear Case:

- About 62% of the operational capacity comes from just one state, Rajasthan, meaning the company is completely dependent on Rajasthan.

- Sector PE is 27, but the company’s current stock PE ratio is 132, meaning the company’s valuation is much higher.

- ROE 3.85% and ROCE 4.89% only, which is naturally much lower.

- Loans are much higher than reserves. The company has to pay higher interest for large loans, which is putting pressure on profits.

- Competition in the renewable sector is increasing, with big companies like Adani Green, JSW Energy, and Tata Power entering this sector.

- Being a PSU company, if the government changes any policy or cuts tariffs, the company’s revenue and profit may go down.

Read More: Can Fin Homes Share Price Target 2026, 2030, 2040, 2050 Forecast

Conclusion

NTPC Green Energy’s business model is very good. The company is already developing many renewable projects in different states like Rajasthan, Gujarat, Maharashtra, and Telangana. The most important of these is India’s major green hydrogen hub, which is being developed in Pudimadaka, Andhra Pradesh. If this project is fully operational, the company’s revenue and profit can increase. Besides, there is a possibility of high income from green hydrogen export and carbon credit business in the future. However, now the company’s CAPEX and debt are a little high because it is expanding rapidly. In the short term, the stock may fluctuate as the valuation is a little premium, but in the long term, this company is likely to show good performance.

FAQ

What is green Hydrogen?

Green hydrogen is a 100% clean fuel made from water using solar and wind power.

What is NTPC Green Energy?

NTPC Green Energy subsidiary, focused on solar, wind, green hydrogen, and green chemicals.

Who Owns NTPC Green Energy?

NTPC Green Energy is 100% owned by NTPC Limited, a Government of India PSU.

Why is NTPC Green Energy’s share falling?

The reason for this stock’s decline is due to profit booking, premium high valuation, market volatility and delay in project execution.

What is NTPC Green Energy’s revenue model?

The company earn mainly from 25-year-long PPAs, selling solar and wind power, consultancy fees and upcoming green hydrogen projects.

Does NTPC Green Energy work in green hydrogen projects?

Yes, the company is developing major green hydrogen hubs, including the Pudimadaka hydrogen project.

Is NTPC Green Energy debt-free?

NO, NTPC Green Energy has high borrowings, but part of its IPO funds will be used to reduce debt.

Does NTPC Green Energy pay dividends?

Currently, NGEL does not pay any dividends because the company is reinvesting all of its money in expanding its renewable energy capacity.

Can NTPC Green Energy reach ₹1,000?

The stock can touch ₹1,000 in the long term if renewable capacity expands strongly and green hydrogen revenue massive boost.

What is the target price of NTPC Green Energy in 2026?

The expected NTPC Green Energy share price target for 2026 is likely to be between ₹79 and ₹230.

What is the share price target of NTPC Green Energy in 2030?

NTPC Green Energy’s share price target may be between ₹450 to ₹850 in 2030.

What is the share price target of NTPC Green Energy in 2040?

NTPC Green Energy’s estimated 2040 share price target ranges between ₹1600 to ₹1960.

What is the share price target of NTPC Green Energy in 2050?

NTPC Green Energy’s estimated 2050 share price target ranges between ₹2600 to ₹2950.

Disclaimer

StockPriceTarget.in is not a SEBI-registered advisor in any way. The price target, analysis or opinion of NTPC Green Energy or any other stock given on this website is provided for informational and educational purposes only. It is not any kind of investment, trading or financial advice. The stock market is completely uncertain, so there is no guarantee that the target given here will be achieved in the future. Do not make investment decisions based on this information. You are responsible for any profit or loss. Before investing, you must consult a qualified SEBI-registered financial advisor.